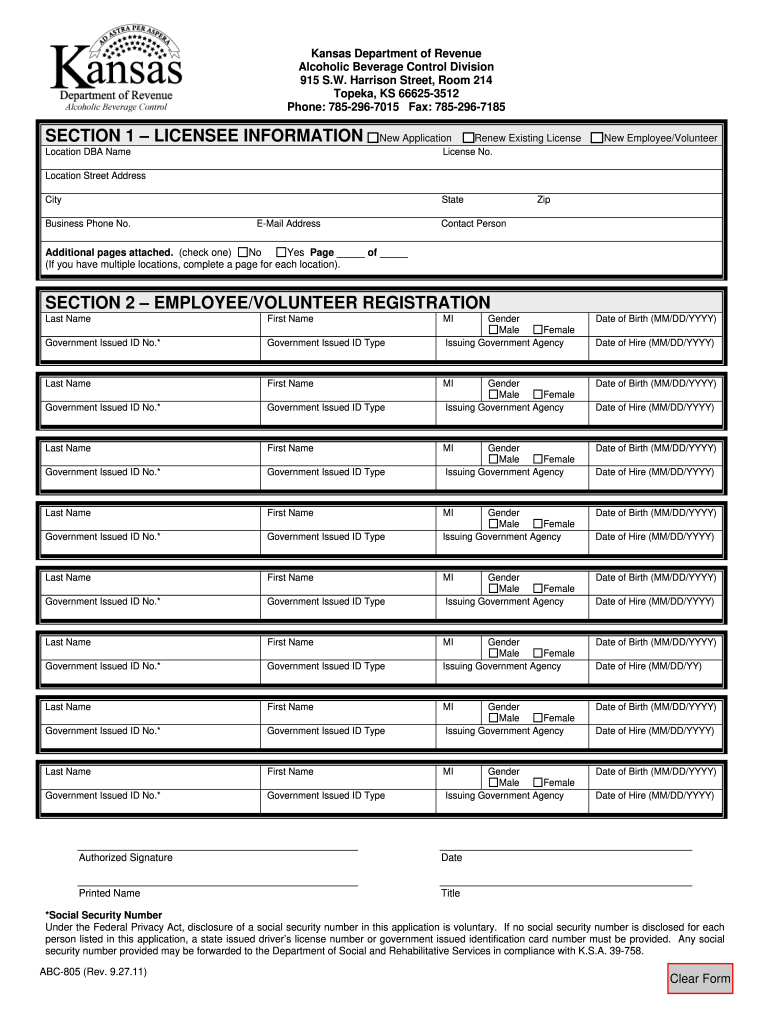

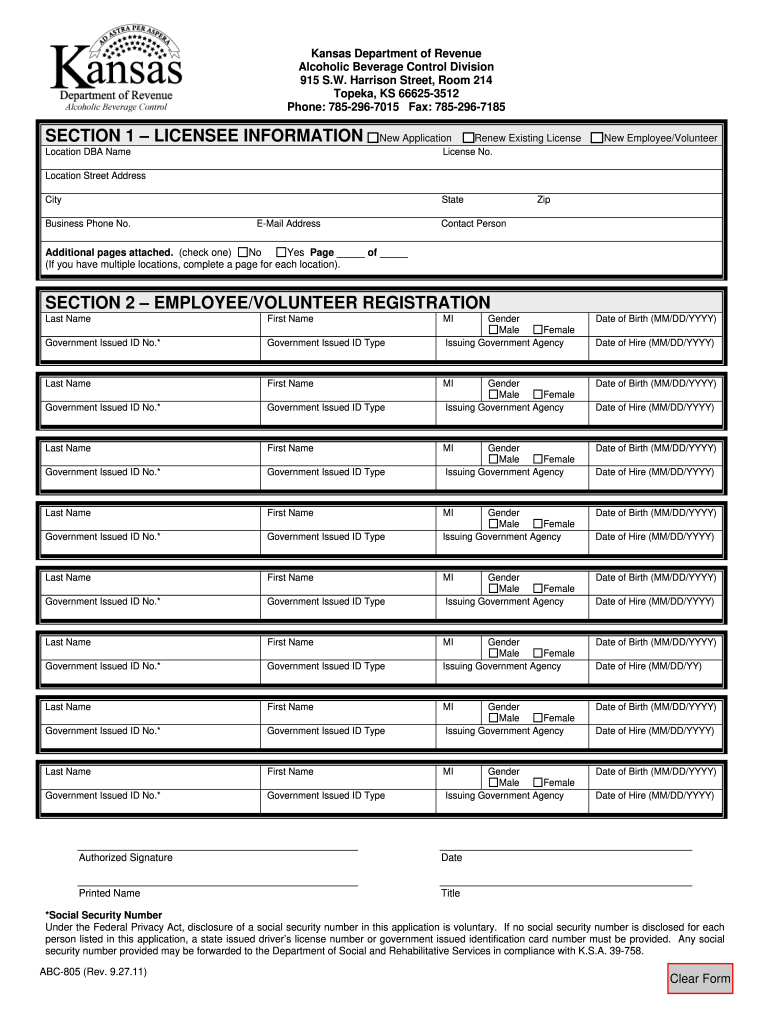

KS ABC-805 2011-2026 free printable template

Show details

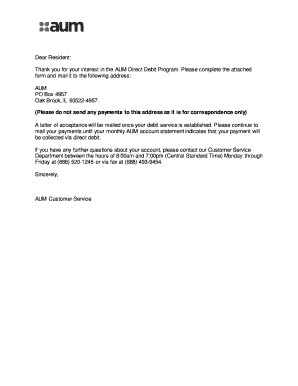

Licensing kdor. ks. gov If you have questions or need assistance completing this form contact us at the number on the form. Email is preferred to Social Security Number Under the Federal Privacy Act disclosure of a social security number in this application is voluntary. If no social security number is disclosed for each person listed in this application a state issued driver s license number or government issued identification card number must b...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ks abc online form

Edit your kansas abc login form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ks abc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit abc form online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit blank kansas id template form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax return ks form

How to fill out KS ABC-805

01

Obtain a copy of KS ABC-805 form from the relevant authority or website.

02

Read the instructions carefully to understand the requirements.

03

Fill in the personal information section with your name, address, and contact details.

04

Provide any required identification numbers (e.g., Social Security Number or Tax ID).

05

Complete the specific sections related to the purpose of the form following the guidelines.

06

Review all information entered for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form via the specified method (mail, online submission, etc.) as indicated in the instructions.

Who needs KS ABC-805?

01

Individuals or organizations that are required to report certain information to regulatory authorities.

02

Businesses that need to comply with specific reporting regulations.

03

Anyone involved in transactions requiring documentation of compliance.

Fill

abc fill

: Try Risk Free

People Also Ask about

How do I know if I am required to file a tax return?

A tax return is necessary when their earned income is more than their standard deduction. The standard deduction for single dependents who are under age 65 and not blind is the greater of: $1,150 in 2022.

What is KS personal income tax?

Kansas Income Tax Brackets and Rates: Married Filing Jointly For the portion of your Kansas taxable income that's over:But not over:Your tax rate for the 2021 tax year is:$5,000$30,0003.10%$30,000$60,0005.25%$60,000—5.70%Source: Kansas Department of Revenue1 more row

Who must file a Kansas return?

If you are a surviving spouse filing a joint federal income tax return, a joint Kansas return must also be filed.Kansas Form K-40 Instructions. A Kansas resident must file if he or she is:And gross income is at least:HEAD OF HOUSEHOLD65 or older and blind$11,700MARRIED FILING SEPARATEUnder 65$ 6,00013 more rows

What is a K-40 form?

If you need to change or amend an accepted Kansas State Income Tax Return for the current or previous Tax Year you need to complete Form K-40. Form K-40 is a Form used for the Tax Return and Tax Amendment.

Do I need to file a KS tax return?

Kansas residents and nonresidents of Kansas earning income from Kansas sources are required to annually file an income tax return, K-40.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KS ABC-805 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including KS ABC-805, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute KS ABC-805 online?

With pdfFiller, you may easily complete and sign KS ABC-805 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I fill out KS ABC-805 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your KS ABC-805. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is KS ABC-805?

KS ABC-805 is a form used in the state of Kansas for reporting and tracking specific types of business activities related to alcohol sales and distribution.

Who is required to file KS ABC-805?

Businesses and individuals involved in the manufacture, distribution, or sale of alcoholic beverages in Kansas are required to file the KS ABC-805 form.

How to fill out KS ABC-805?

To fill out KS ABC-805, provide the required identification information, details of the alcoholic beverages sold or distributed, and any relevant financial information as outlined in the form instructions.

What is the purpose of KS ABC-805?

The purpose of KS ABC-805 is to ensure compliance with state regulations governing the sale and distribution of alcohol and to maintain accurate records for regulatory oversight.

What information must be reported on KS ABC-805?

Information reported on KS ABC-805 includes the seller's information, types and quantities of alcoholic beverages sold, sales data, and any other relevant details required by state authorities.

Fill out your KS ABC-805 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS ABC-805 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.